SURETYSHIP

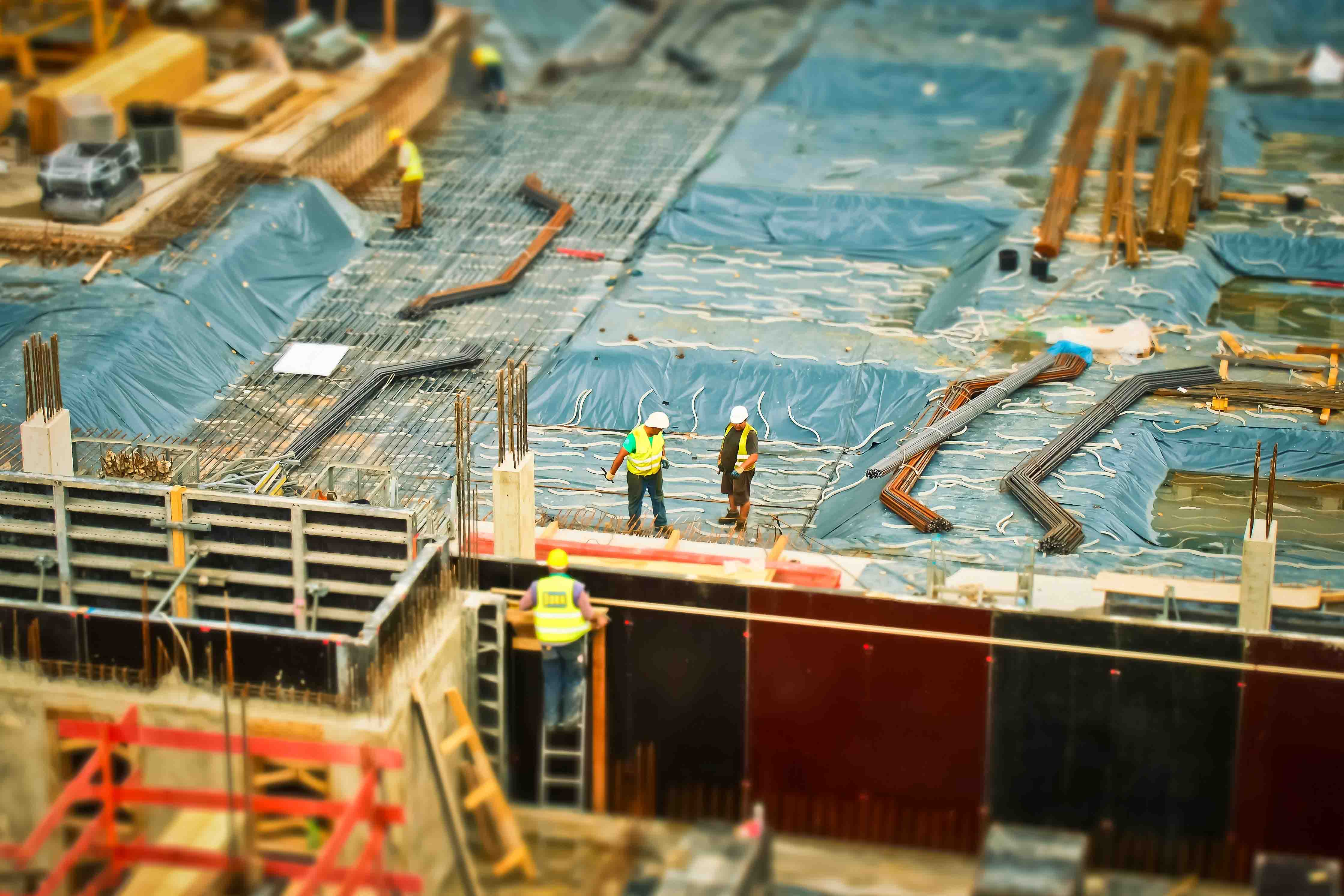

Suretyship Insurance is intended as a written agreement between Surety and Principal to provide guarantees to the project owner (Obligee). The Principal will fulfill obligations in accordance with the agreement or contract made together with the Obligee.

Suretyship Insurance Products:

-

Tender Guarantee Insurance

This insurance product is intended as a guarantee to the project owner (Obligee) in case of the Principal’s resignation in participating in a tender or refusing to sign a contract with the Obligee after being appointed as the winner of the tender.

-

Implementation Guarantee Insurance

A guarantee is given to the Principal to complete the work according to the standard and the time specified and stated in the contract or work agreement.

-

Down Payment Insurance

This product comes in the form of a guarantee of a refund for the down payment received by the Principal from the project owner (Obligee).

-

Maintenance Guarantee Insurance

Maintenance Guarantee is a guarantee for the Principal’s obligations given to the project owner (Obligee) during the maintenance period.

Bank Guarantee Cons

Bank Guarantee Cons is an insurance product that comes in the form of Guarantee Proof from Surety on Bank Guarantees that have been issued by Commercial Banks for the interests of the Principal in accordance with the requirements given by the project owner (Obligee). In this case, Surety has an agreement to pay compensation to the bank for claims submitted by the project owner (Obligee).

Bank Guarantee Cons:

- Bid Bond

- Performance Bond

- Advance Payment Bond

- Maintenance Bond